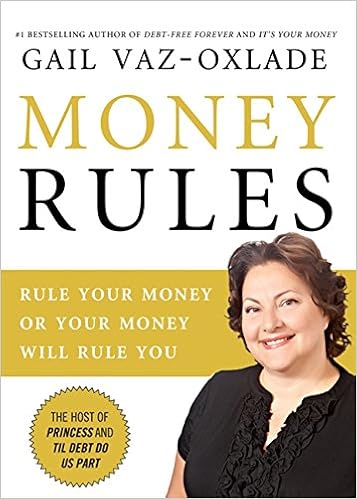

By Gail Vaz-Oxlade

Gail loves to say that cash is not rocket technological know-how, it really is self-discipline. yet even she recognizes that there are tips to her exchange and that earning money judgements usually feels extra complex than it may. So, the place to begin? With Gail's funds ideas, in fact, her crucial principles for making your funds paintings for you.

Covering each subject below the monetary sun--from TFSAs to taxes, borrowing to breaking undesirable conduct, relationships to RRSPs--Gail tells readers that a number of the principles they've been following may well truly be operating opposed to their most sensible pursuits. a few of her suggestion is, as she says, logic (Rule #17: wishes needs to Come sooner than Wants), a few of it really is mind-blowing (Rule #222: do not Borrow to give a contribution to an RRSP), and a few is even counterintuitive coming from Gail (Rule #261: show pride out of your Money). all the ideas are brought in digestible items that every provide the reader a transparent experience of what works and what doesn't.

For money-phobes, this ebook should be a kick within the pants; for money-minders, it is going to ease the concern that there should be a monetary tone they have left unturned; for everybody else, Gail's ideas offer what it takes to construct a robust monetary starting place that might final an entire life.

Read Online or Download Money Rules: Rule Your Money or Your Money Will Rule You PDF

Similar personal finance books

The Complete Chapter 7 Personal Bankruptcy Guide

Your Easy-to-Follow motion Plan for monetary restoration combating off collectors and attempting to pay mountain-high accounts can weigh a person down. cease dwelling day by day and regain regulate of your funds as soon as and for all. the whole bankruptcy 7 own financial disaster consultant might be useful positioned an finish to the abusive strategies of assortment corporations and consultant you thru submitting your personal financial disaster.

Live It Up Without Outliving Your Money!: Getting the Most From Your Investments in Retirement

Thoroughly increased and up-to-date, reside it Up with no Outliving Your cash! moment variation is the monetary roadmap that individuals are searhing for. in line with the author's event within the monetary prone region because the mid-1960s, together with greater than 30 years as an funding consultant and cash supervisor, this plain-talking publication provides readers basic concepts so as to add among $1,000 and $10,000 to their per 30 days source of revenue in retirement, and with no taking any of the dumb dangers of the previous.

Needed outlined contribution pension markets are found in progressively more international locations worldwide. yet regardless of their recognition, policymakers proceed to fight with key coverage matters. at the one hand, a couple of layout shortcomings encourages pension agencies to cost excessive administrative charges.

Intuit QuickBooks Enterprise Edition 12.0 Cookbook for Experts

QuickBooks company version 12. zero for specialists is a cookbook with particular recipes for time-saving shortcuts, helpful custom-made experiences, and spectacular how you can use this accounting software program to aid decision-making on your small or medium-sized business.

With QuickBooks firm version 12. zero Cookbook for specialists you could pick out a subject matter of worth and examine particular, functional strategies usable on your personal QuickBooks dossier or in a pattern file.

This e-book is rooted within the longstanding gains of QuickBooks and comprises the most recent instruments, no matter if you’re upgrading from foremost or from a previous model of the company version. themes comprise customizations, time-saving equipment, integration with Microsoft Excel, and distinctive instruments and setup options for hyper-efficient details retrieval and analysis.

Whether you're an self sufficient or accountant, no matter if you're a book-keeper, controller or CFO, QuickBooks firm version 12. zero Cookbook for specialists can help you to extend what's attainable on your business.

What you'll study from this book

customise the QuickBooks surroundings and experiences to compare your operating variety and enterprise operations

Optimally arrange goods and different instruments to get the main important info out of your accounting records

store time with correct keyboard shortcuts, information access shortcuts, and reporting shortcuts

effectively deal with your consumer and seller relationships through the use of QuickBooks in mind-blowing ways

bring up supervisory potency and effectiveness with troubleshooting ideas and error-checking tools

extend reporting and research services by means of extra exploring integration with Microsoft Excel

manage QuickBooks for enterprise-level issues together with multi-user permissions, add-on providers, and record storage

Create stories to bolster relationships along with your key clients, proprietors, traders, and different stakeholders

Approach

QuickBooks firm variation 12. zero Cookbook for specialists is written in a non-sequential, modular manner which allows the reader to choose any appropriate and priceless procedure and study it. each one recipe within the cookbook comprises illustrations to take advantage of tough innovations basic. moreover, the professional reader’s time isn't wasted on any simple language and steps.

Who this ebook is for

This ebook is written for CPAs, CAs, specialists, CFOs, controllers, managers, or bookkeepers with vast event with QuickBooks. previous event with the firm variation, besides the fact that, isn't required. you will have an intensive realizing of accounting methods and a mastery of the fundamentals of the QuickBooks atmosphere.

- Debt-Free U: How I Paid for an Outstanding College Education Without Loans, Scholarships, or Mooching Off My Parents

- The Money Tree: Help Yourself to Greater Wealth, More Security and Financial Happiness

- Your Network Is Your Net Worth

- A Man Is Not a Financial Plan: Investing for wealth and independence

Additional resources for Money Rules: Rule Your Money or Your Money Will Rule You

Example text

Think protecting a young family. Think paying off a mortgage or other debt. Term insurance is an expense, like rent. While it will give you comfort and peace of mind, it accumulates no residual value. If you want insurance coverage to last your lifetime, permanent insurance, including whole and universal life, is a better choice. Permanent insurance not only provides you with a death benefit that does not expire, it also includes a savings portion through which you can build up a cash value. Later you can borrow against that cash value or withdraw the cash value to help meet some future goal.

If all your ducks line up and you want to buy, then buy. If they don’t, you should not be squeezing yourself into home ownership because you think that with it comes some magical financial stability you can’t get if you don’t own. People twist themselves into knots trying to own their own homes. They overextend themselves. They buy with little or no down payment just to get into the market. They squeeze their cash flows and have to turn to credit to make ends meet. Home ownership can be a big ol’ pain in the arse.

That means on a $200,000 house, you’d need to include about $500 a month in your budget for maintenance. If you can do it yourself, you’ll save on labour, so you can put away a little less. If you must pay someone else, your costs will be higher, so don’t skimp on your maintenance budget. YOU if you’ll wipe out all your savings. Would you do ANYTHING to get into a home of your own? Would you take money from your retirement savings plans? Would you tap your tax-free savings accounts (TFSAs)? Would you annihilate your emergency funds?